The Supply Chain Crisis

As the impact of coronavirus continues to unravel, worldwide supply chain issues are the latest problem to take centre stage. Some of the world’s most important ports are blocked and congested, truck drivers are massively undersupplied and shortages of essential goods such as semiconductors and lumber are causing havoc in almost every goods-based industry. Due to the interconnected and global nature of modern supply chains, the whole world has experienced uncomfortable frictions. Even in the world’s biggest economies issues have persisted. Mass congestion at Long Beach port has caused prices for containers to increase massively, whilst hysteria created by shortages of petrol in the UK forced the British Army to step in.

What Has Caused the Supply Chain Crisis?

The reasons behind the crisis stem from the way supply chains are inherently structured. To minimise costs, the different stages of the supply chain are separated at a granular level. Goods are shipped back and forth across the globe to benefit from differing trade regulations and costs of factors of production. Additionally, tight inventories are held on a just-in-time basis to minimise costs further. This results in an extremely efficient yet fragile system; every last penny of profit is squeezed out, but its interconnected nature makes the whole supply chain extremely prone to shocks. As lockdown restrictions are lifted, supply chains have become overwhelmed. A surge in pent up demand combined with productive capacities slowly getting back up to speed has caused a plethora of frictions across the supply chain. The complexity of coordination has only exacerbated the problem, where demand expectations are amplified and distorted as the information travels up the supply chain, a phenomenon known as the bullwhip effect.

How Have Financial Markets Been Impacted?

Even though chaos persists on the roads and ports of some of the world’s largest economies, financial markets paint a contrasting picture. In general, the impact of supply chain disruption has been better than expected. Since the start of September, the S&P 500 gained 1.65% and the Dow Jones Industrial Average rose 1.1%, according to Bloomberg. The rally in the stock market reflects investors’ post-pandemic optimism given the prevailing economic conditions. As the economy reopens, a resilient consumer demand seems to be shaking off any issues from increasing oil prices to China’s slowing economy, and supply chain woes are no exception. Paired with a fast-approaching holiday season and an expectation for interest rates to remain low, optimism in the market is well justified and likely to stay for the foreseeable future.

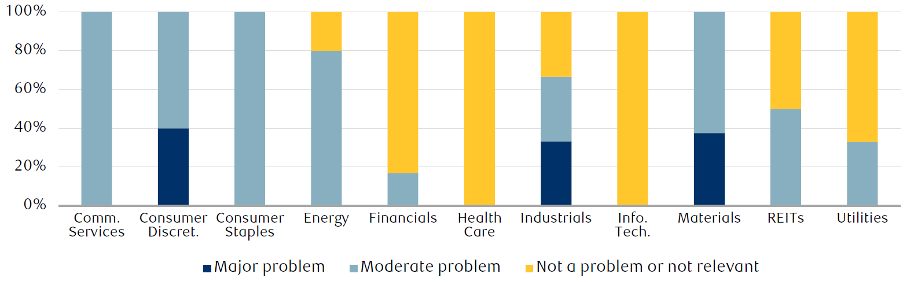

In response to investor optimism, businesses across all sectors have adapted to supply chain issues very well. According to Bloomberg, more than 82% of firms (that reported) beat analysts’ predictions of profits, a frequency that has never been seen since 1993. From an outside perspective, equity analysts in a recent RBC survey flagged just 3 industries as having ‘major issues’ with supply chains.

Most businesses have smartly responded and reacted to overcome supply chain obstacles. In one extreme case, Home Depot took urgent measures to secure their own cargo ship to deliver supplies in the short term. Further, a number of companies with already resilient supply chains have reaped the rewards. For example, Toyota, who consolidated its supply chains after an earthquake last year, reported a 1.4% increase in sales last quarter. Improvements on the most basic operational level have also been made, where logistics firm Flexport is using machine learning technology to increase the capacity per shipped container. This reassuring reaction by businesses has compounded investors’ confidence, a prosperous but potentially dangerous cycle.

This is not to say that supply chains are a benign spectacle. Even though disruptions have not systemically dismantled any industries, it is still a widespread threat to earnings. 94% of Fortune 1000 companies have experienced disruptions and 55% of businesses have had to downgrade their growth, according to consulting firm Accenture. A number of businesses have experienced severe difficulties, for example, Bed, Bath and Beyond shares have fallen by over 20% in late September. The rapid nature of Covid-19 and its knock-on effects can seriously harm businesses, especially coming into the important holiday season. Additionally, there is a huge risk of inflation causing havoc in the markets. If supply chain issues persist, inflation will continue to rise, consequently eroding earnings and consumer spending power.

What Does the Future Hold?

With a fresh batch of problems reported each morning, the supply chain crisis is showing no signs of slowing down. Long term restructuring of supply chains is likely to be the only long-term solution, an expensive and complex task that is almost impossible to coordinate. The implications are highly debated, with some economists relegating these impacts to fleeting teething problems as the economy reopens, and others warily warning that these disruptions are here to stay. In spite of this, the stock market continues to soar, closely following strong consumer demand. For how long this demand can continue to fend off supply chain chaos and international turmoil is an intriguing question that only time will be able to tell.