Sentiment Report - SOS LTD

This report will be analysing SOS Ltd’s stock for the week commencing 1st March 2021. This will be done using StockGeist, a platform that determines the sentiment towards a stock in real-time, by applying natural language processing to the latest news updates and social media posts. All times given are in GMT+0.

Company Overview

SOS Ltd, formerly China Rapid Finance Ltd, is a holding company based out of China with a focus on emergency services. Through its subsidiaries, SOS Ltd utilises blockchain and satellite communication to provide cloud computing and marketing services to several members of the emergency rescue market, including insurance companies, medical institutions, financial institutions and more.

Historical Analysis – 2020 and Early 2021

From the beginning of 2020, SOS Ltd saw a five-month-long bearish downtrend in their share price. This was likely caused by the company’s poor financial performance in the preceding year, with -$9.90 million in earnings (-85.12% change from 2018) and $37.66 million in revenue (-43.48% change from 2018), which were declared in December 2019. After a slightly bullish period that proceeded this downtrend, the value of SOS Ltd’s stock remained relatively stagnant for the remainder of 2020.

However, from the beginning of 2021 to mid-February, a surge of approximately 720% ($1.44 to $11.84) in share price was observed, owing to a few key catalysts. The sharp rise in the value of Bitcoin around this period was one such catalyst, largely due to the fact that SOS Ltd had announced the purchase of a large batch of crypto mining rigs in January. This purchase proved to be incredibly profitable for the firm very quickly, which attracted a large number of new investors. The rise in the value of Bitcoin also brought more positive attention to the future of blockchain technology – a technology that is greatly utilised by SOS in the provision of their services.

This spike in value, however, was quickly followed by a sharp downturn. One possible cause of this immediate reversal was SOS Ltd’s announcement in early February that it had entered into a securities purchase agreement with certain accredited investors to purchase $86 million worth of warrants that could be exercised for $7.00 to acquire American depositary shares of the company. As the share value reached new highs for over a year, speculators and retail investors instigated a selloff, which enticed other investors to exercise their warrants and sell their shares to ensure a profit on their part. This negative feedback cycle allowed for the value of the stock to fall around 50% in the space of only two weeks.

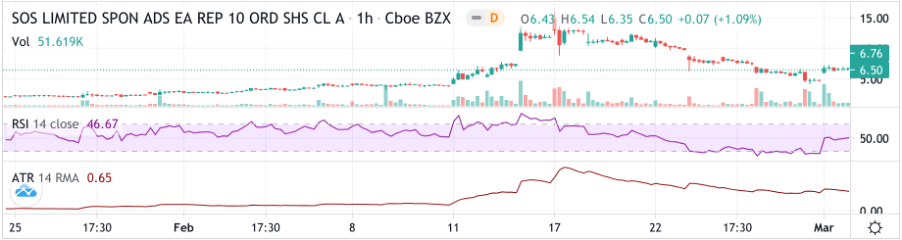

Brief technical analysis also shows that the value of the shares was relatively overvalued following this spike, as the relative strength index (RSI) reached highs of around 87, indicating the stock was in an overbought state. Additionally, the average true range (ATR) rose from 0.22 to 1.54 in a six-day timespan, indicating excessive volatility – this suggests a certain price level cannot be maintained, and may be one of the reasons, alongside the RSI value, why a selloff was initiated.

Recent Analysis – Week Commencing 1st March

SOS Ltd’s stock had a good start to the week commencing 1st March, opening 1.29 points above last month’s close. This bullish movement maintained its momentum for a few days up until 4th March, where a trend reversal was observed. Despite breaking the $6.50 support level, the value of the stock was able to recover slightly on the final trading day of the week, closing at $6.50 (a 7.26% overall increase).

Recent news combined with StockGeist’s sentiment data can provide some insight into these price movements. The 27% jump at open on 1st March strongly reflects pre-market sentiment, with informative messages being 50% positive and emotional messages being 38% positive (at 14:00). For the couple days that ensued, positive sentiment remained dominant, which allowed for the continuation of bullish momentum.

However, at 17:00 on 3rd March, Hagens Berman announced an investigation into a possible securities law violation (which StockGeist highlights as negative news). This investigation centres on the accuracy of SOS’s claims concerning its cryptocurrency mining assets and capabilities, and Hagens Berman encouraged SOS investors, who may have had valuable claims, to contact its attorneys. This inevitably drew a lot of attention to SOS on social media, as shown by the peak in the number of messages on StockGeist’s real-time sentiment tracker (18:00 on 3rd March). A spread of positive, neutral and negative sentiment around this time suggests that personal opinions were being presented on both sides of the legal case; it was likely this uncertainty caused recent gains in share value to be erased over the next few days. Pre-market data on 5thMarch showed 25-15% negative sentiment (a fall from the previous spread of negative messages surrounding the allegations), as many on social media started to believe that the previous claims were untrue, which allowed for the value of the stock to partially recover over the course of the day.

Accuracy Test – 1st March to 3rd March

Informative Messages

Emotional Messages

Methodology

StockGeist’s sentiment data was used to identify certain thresholds, calculated by finding the relative difference in the number of negative/positive messages compared to the largest of the other two categories. A percentage was then calculated to determine how often the value of the stock would increase/decrease under the specific threshold. The average price change for that threshold was also calculated, by subtracting the opening price from the closing price of an hourly period. For example, when there was 50% more (1.5x threshold) positive informative messages than negative or neutral messages, the price would increase by 0.11% on average; 50% of these price changes were positive (increases).

Results and Reflections

The accuracy test shows that a correlation exists between the number of positive/negative messages and the value of the stock. Emotional messages in particular show stronger correlation; for example, a threshold of 0.75x (25% fewer) negative emotional messages gave an average price decrease of 0.33% with 100% accuracy for this week of trading. This reflects the increasing evidence of social media’s relationship with the stock market. While the informative positive messages may not have been entirely accurate in determining increases in SOS Ltd’s share price, it is important to remember that this data works best alongside an additional set of information that is also provided by StockGeist, such as fundamental metrics and the world cloud.

Outlook and Conclusion

At present, SOS Ltd’s stock price continues to fluctuate, likely caused by the ongoing (and currently inconclusive) investigation by the SEC. SOS also plans to offer 23.88 million more warrants for the purchase of their American depositary shares, which is expected to cause their share value to decline as it did previously. StockGeist’s sentiment data and news highlights accurately reflected price movements following the company’s warrant offering in the first instance, which strongly suggests that data presented by StockGeist can act as a useful tool to predict further movements in these times of uncertainty for the company.

Disclaimer

This report and analysis of SOS Ltd’s stock was performed to determine whether positive messages detected by StockGeist translated into an increase in stock price, and whether negative messages translated into a decrease in stock price in the week commencing 1st March. Please note that this analysis is not investment advice.