What Is the Relationship Between Brexit and the FTSE 100?

Current State of the Brexit Negotiations

On 31st January 2020, Britain ended its 47-year membership with the European Union, triggering the 11 month ‘transition period’ set to end this year on December 31st [1]. During this period, many arrangements from the UK’s membership, such as the EU laws on freedom of movement, cross border travel and personal rights have been sustained temporarily. However, in 2021 Britain will no longer abide by these rules, with one of the main implications being an expiration of its membership in the EU’s Single Market and Customs Union. This will give Britain the task of implementing its own independent trade policy [2].

The complexities of this future trading relationship were brought to light when following Britain’s initial departure in January, Michel Barnier, the EU’s chief Brexit negotiator was given a new mandate from the European Council to negotiate a potential trade deal between the UK and the EU [3]. However, if an agreement is not made before December, or Boris Johnson’s recent more aggressive deadline of October 15th, the UK will become a ‘third’ country to the EU in legal terms and trade under WTO rules. EU negotiators are desperate to ensure British exports don’t gain a competitive advantage over European goods, whilst simultaneously demonstrating to all current EU member states that membership of the bloc provides far better economic prospects. These tactics combined with Johnson’s determination on the UK’s independence as a sovereign nation has led investors and commentators to question if this 11-month transition period, amidst a global pandemic, was simply too ambitious.

How Does This Relate to the FTSE 100?

The most defining link between Brexit and the UK stock market is the four years of underperformance of the FTSE 100 compared to other major market indexes across the world following the 2016 referendum. Investors would have gained a 13.3% higher return if they had invested in the US instead. Even investing in Latin America, where markets are fraught with political volatility and debt defaults would have provided better profits [4]. This decline has been driven by a loss of interest from both international and domestic investors. Between January 2016 and June 2020, retail investors withdrew nearly £13bn from UK equity funds, with just 14% of British retail investors’ assets left compared to 23% before the referendum [5] . To establish causality between the economic and political implications of Brexit and the impact on investment, I will also consider if other factors, such as the composition of the FTSE 100. Looking forward to 2021, could a Brexit deal mark a turning point in investors’ attitudes towards the British stock market, or will the index continue to perform weakly compared to its peers?

Sterling Depreciation

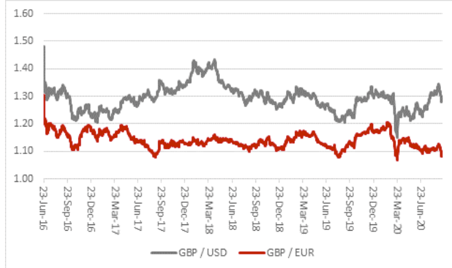

One significant implication of the Brexit referendum was the large depreciation of the pound that ensued, with implications for the UK economy and equity markets. As seen in the graph, the pound’s depreciation after the referendum was significant, and its value against the euro and dollar has since failed to recover [6]. As the pound is a free-floating currency, it can be traded by speculators which makes it a useful ‘safety valve’ for prospective investors [7]. In recent years, traders have been reacting to political changes and making faster paced trades, causing higher volatility at times of Brexit developments. This is a clear deterrent for overseas investors due to the concern that large currency movements will impact returns. Thus, it is more attractive to invest in stock markets elsewhere with greater currency stability, such as the US’ S&P 500 and Europe’s Stoxx 600 [[8]](http://] https://www.ft.com/content/4fd04fd9-7209-4b7c-97a1-97466f226159). According to Bank of America analysts, the pound can now be seen as an emerging market currency, showing more similarities to the Mexican peso than the US dollar [9]. Investor sentiment, particularly from an overseas perspective has therefore remained extremely cautious, lowering demand and valuations for UK stocks.

On the other hand, a weak sterling’s economic implications on FTSE 100 stocks could be seen as an advantage. Approximately 75% of FTSE 100 revenues come from abroad, as a large proportion of companies are multinational. This implies following a depreciation, when foreign currency is converted back to pounds it increases these companies’ earnings and profitability [10]. For example, Burberry, who makes 85% of sales abroad saw a rise in share price of 24% between June 23rd 2016 October 2016 post referendum [11]. In contrast, the FTSE 250, which is made up of smaller, more domestically focused companies experienced a larger decline following the Brexit vote of 7.2% [12]. Although this has not provided a sufficient positive effect on the FTSE 100 to counteract its weak performance, as the index still initially declined 3.15%, in the case of a Brexit no deal a further depreciation in the sterling is a likely outcome. Boris Johnson’s aggressive rhetoric towards the new October 15th deadline has increased volatility in the currency this month, with the sterling falling 1% against the dollar in one day of trading on September 7th as investors considered the rising probability of a no deal [13]. A weaker sterling may also boost valuations for British exporters by making their goods more price competitive, improving Britain’s prospects in newly agreed trade deals, such as those recently agreed with Japan and Switzerland.

Overall, the loss of investor confidence and capital flight in the case of a no deal will likely outweigh any positive impact from a weaker pound. A Brexit deal, and the clarity it would provide over Britain’s economic outlook may reduce sterling volatility. An appreciation in the pound could signal to investors the possibility of a stronger economic future for Britain, and instil greater confidence in the currency in the long run.

Composition of the FTSE 100

The FTSE 100, like other major indexes is weighted by market capitalisation. This means a company’s representation in the index is based on its size, with a company’s performance contributing to overall FTSE 100 proportionately [[14]](http://] https://www.ftserussell.com/education-center/how-are-indexes-weighted). However, traditionally the main source of attraction to British stock markets has been the high dividend pay-outs that shareholders receive. This provides high total returns over time with a far more positive trajectory than simply looking at the FTSE 100’s valuation over recent decades [15]. These stocks providing traditionally strong dividends include oil and mining companies, banks and insurers such as Royal Dutch Shell, HSBC, Rio Tinto and BP which all appear in the FTSE top 10.

A recent survey from the Confederation of British Industry which consulted 648 British businesses representative of all UK industries found that only 4% would prefer the outcome of a Brexit no deal, and 77% were in favour of an agreement [16]. This highlights the importance of free trade with Europe, especially given the backdrop of other global trends and events that have emphasised weak performance of dominant industries within the FTSE 100. For example, the recent trend of ESG investing has been detrimental to BP and Shell, and combined with the financial impact of historically low oil prices has forced both companies to reinvent their strategies to focussing on renewables and making net zero carbon commitments for the future [17].

Although UK banks were predicted by the Bank of England to be strong enough to endure a contraction in the UK economy of up to 30%, banks such as RBS, HSBC and Barclays saw a fall in share price in May 2020 to levels similar to the 2008 financial crisis [18]. This has been mainly caused by a fall in profitability as interest rates were cut to 0.1% and banks made huge provisions for business and consumer loans. These industries alongside others in the FTSE have either cut dividends or cancelled them completely this year due to the pandemic, removing the traditional “USP” (unique selling point) FTSE stocks retained over competitors abroad.

Moreover, the relative weightings of the technology industry in British and US stock markets has seen a significant divergence and can further explain FTSE underperformance. Technology’s weighting in the S&P 500 increased from 11.3% to 27.5% between 2016 and 2020 [19]. The FTSE 100 has a current technology weighting of 2.6%, and therefore did not reap the benefits of the technology boom recently seen in stock markets since March.

Despite the negative impacts of coronavirus worsening FTSE 100 performance in 2020, a recent survey from the London School of Economics suggested the economic cost of a no deal Brexit could be up to 2 to 3 times as bad as the pandemic’s impact, amounting to approximately £40bn [20]. Given how strongly weighted FTSE industries are to cyclical changes, this would be detrimental to the index’s performance, particularly without technology or high dividends cushioning a potential sell off.

Conclusion

Overall, a Brexit deal which provides investors with clarity over trade and highly contested political issues such as the Northern Irish border would certainly provide a boost to investor sentiment and the economic outlook. However, considering the current state of the UK economy, for the FTSE to perform strongly in future years investors will require more positive signals than just a Brexit deal. This will likely appear in the form of positive economic data, such as higher inflation and economic growth that may eventually cause a rise in interest rates and provide a boost to valuations of strongly weighted cyclical industries, especially banks. With inflation currently at 0.2%, this may take several years to become a realistic scenario for Britain.

Even in the event of a deal, the pound will require an economic recovery to repeat its pre-2016 levels of performance. Until then, a weaker pound may be beneficial for multinational FTSE stocks, and strong export competitiveness will provide British exporters with a promising start to trading relationships elsewhere.